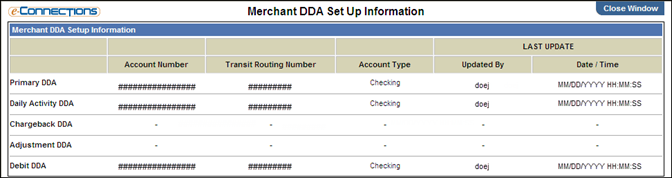

Demand deposits or non-confidential money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are deposits in the bank that can be withdrawn on demand, without any prior notice. That particular DDA account is set up and used only for this process, and works in the following manner: The customer uses card that taps into a DDA account that has a zero balance. The account automatically advances the amount of the transaction into the DDA account. So the account is debited, shows a negative balance, which is then zeroed out. Demand deposits and term deposits refer to two different types of deposit accounts available at a bank or similar financial institution, such as a credit union. Demand deposits and term deposits.

The Servicer will cause all collected and identified funds on deposit in the Master DDA Account to be swept to the Collection Account within one (1) Business Day after identification.

Demand Deposit Account Definition

The Servicer and the Borrower shall direct the Obligor of each Pledged Receivable to remit all Collections owed by such Obligor to the Lockbox or by wire transfer to the Master DDA Account or the Collection Account (and except as provided in the Intercreditor and Lockbox Administration Agreement shall use its best efforts to ensure that only funds constituting Collections shall be deposited into the Lockbox and Master DDA Account).

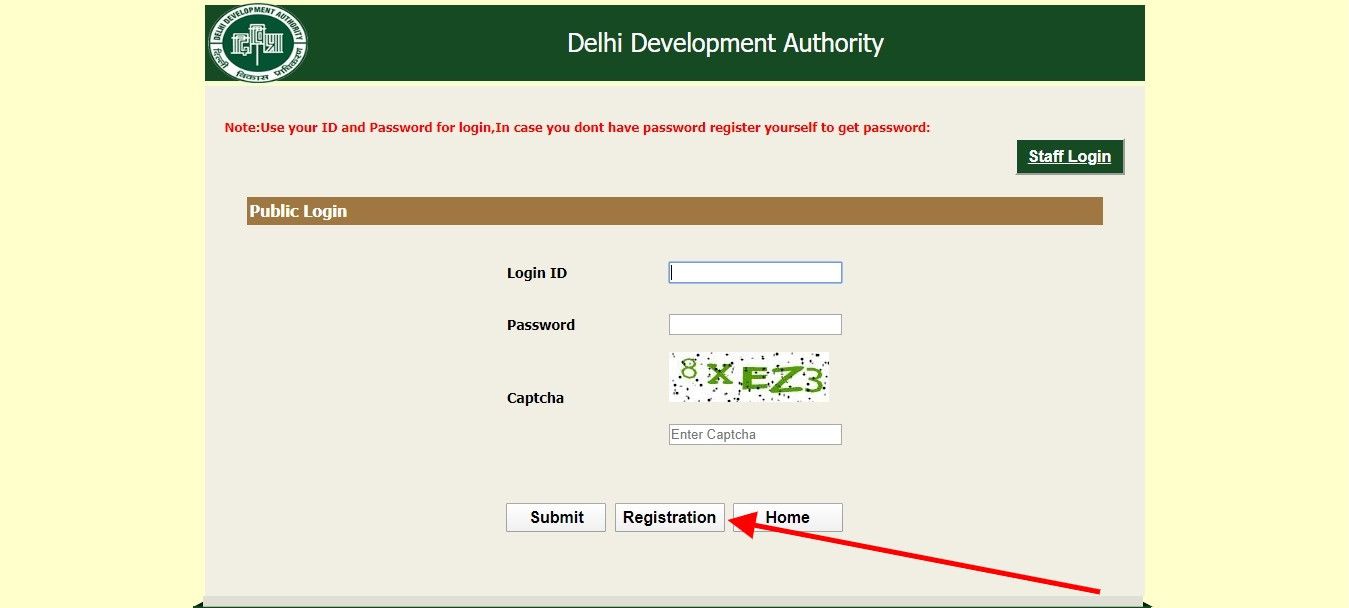

Dda Account Closure

Until the Collection Date, the Borrower shall have no rights of direction or withdrawal, with respect to amounts held in the Collection Account (other than amounts remaining after giving effect to the application of Section 2.06(a)(I)(i) through (xi) and Sections 2.06(a)(II)(i) of this Agreement) or the Master DDA Account, except with respect to funds not related to any Pledged Assets, which were incorrectly deposited into any such account.

The Borrower shall ensure that the Backup Servicer has access to account information with respect to all deposits, withdrawals and reconciliations with respect to the Lockbox, Master DDA Account and the Collection Account.

As soon as reasonably practicable and in any event within two (2) Business Days after occurrence, notice of any change in (i) the name, account number, or similar information pertaining to the Lockbox, the Master DDA Account and/or the Collection Account, (ii) the Custodial Agreement as it relates to the Collection Account or (iii) any other documents, agreement or arrangement concerning any of the above-mentioned accounts.

Dda Account Means

Close Account Due to Account Abuse?

11/24/2019

We have a customer who we recently refunded $630 of Returned NSF Fees and Continued Negative Balance Fees to after stating the items came thru sooner than scheduled (Reg E). The account went positive for one day and has now been negative for 17 days since (62 days NSF last 12 months). She has another account that is currently positive but that account has also had 41 days NSF. Can we close her accounts due to account abuse or failure to maintain account in a responsible manner?